Simplify Compliance with Online Identity Verification and Risk Assessment

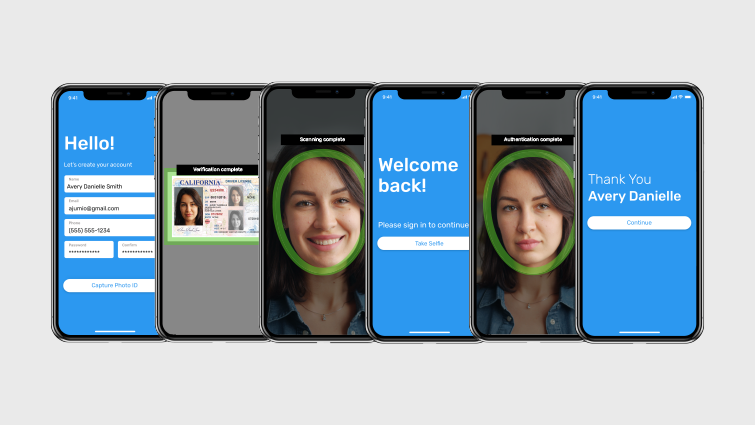

Fulfill Know your Customer (KYC) requirements with accurate, real-time online ID and digital identity verification. Replace slow, ineffective and manual KYC processes with more automated solutions that can be embedded within the online account setup and onboarding experience.

- Convert and Onboard Customers Faster

- Meet KYC/AML Regulatory Compliance

- Fight Fraud and Protect Online Channels

- Real-time Identity Verification

- Onboarding to Ongoing Monitoring

Request a Call with an Expert