End-to-End AML Compliance Solutions

Fight financial crime in the cloud. Prevent, detect and report money laundering activities to fulfill your AML regulatory obligations.

- Automated User Onboarding

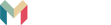

- Customizable Risk Screening

- Powerful Case Management

- Regulatory Reporting