End-to-End Identity Verification and AML Solutions

Discover the end-to-end identity verification, online fraud detection and ongoing AML monitoring services trusted by leading financial services organizations worldwide.

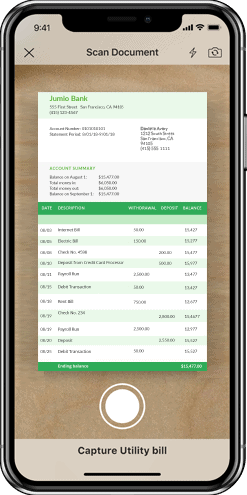

- Convert and Onboard Customers Faster

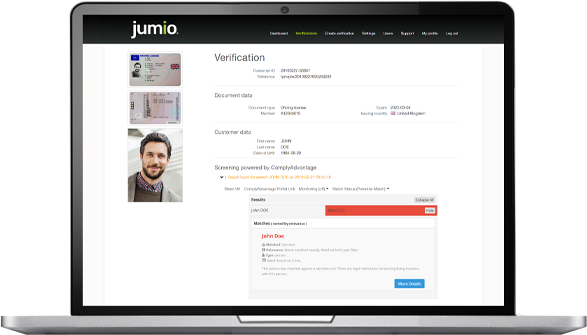

- Meet KYC/AML Regulatory Compliance

- Fight Fraud and Protect Online Channels

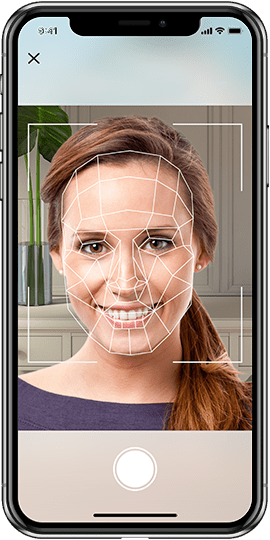

- Real-time Identity Verification

- Onboarding to Ongoing Monitoring