Remote Customer Onboarding for Banks and Financial Institutions

Banks and other financial institutions in a number of European, Latin American and Asian countries are allowed to use a video-based customer identification process for KYC, enabling these institutions to remotely onboard customers instead of requiring them to physically visit a branch office. Moreover, we expect other industries such as online gaming to require video verification in the near future.

Convert more customers and dramatically reduce abandonment rates.

Stop fraudsters and money launderers from the start, and keep them out.

Meet strict requirements for AML and KYC compliance.

3 Modes of Video Verification

Assisted

In the assisted mode, customers are identified through video assistance technology with dedicated or shared agents that interact in real-time via browser or mobile.

Unassisted

In unassisted mode, your customers will independently capture a video of their identity documents, take a picture of their face and perform a liveness test without an online agent. Verification happens through a combination of AI and expert review.

Platform Only

If you choose to use our platform, customers are identified and verified through video assistance technology staffed by your agents.

How It Works

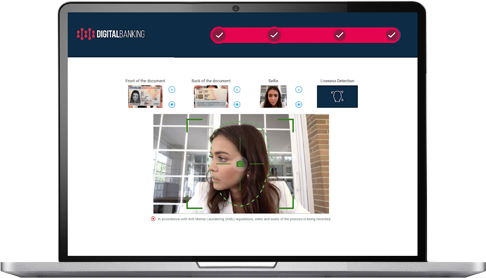

Financial institutions verify customers through live video interviews along with identity document verification and biometric authentication. AI-based solutions such as facial recognition and liveness detection technology ensure the physical presence of the individual as well.

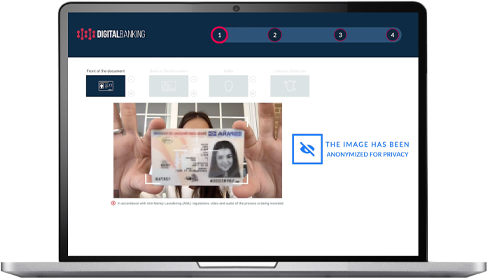

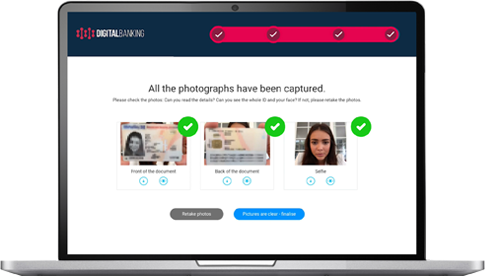

The customer shares their government-issued ID and a real-time selfie with a video agent or through the platform.

These images are sent to Jumio’s API, and Jumio checks the validity of the ID and the identity of the customer.

Jumio Video Verification performs a liveness detection check (either by agent or platform) to determine if the customer is physically present and provides definitive verification results to our business customers to complete the onboarding process.

The entire process is recorded and provided to the financial institution as evidence of KYC compliance.

See Video Verification in Action